You may be over budget on one and under budget on the other but as long as they balance out it makes no difference. If you go out to eat more often, you’ll spend less on groceries. This is useful if you don’t care too much about where money is being spent in a given sub-tree as long as you don’t exceed a total.įor example, you may have a Food category with subcategories of Dining Out and Groceries. The Reminder Review displays them in this same structure and aggregates totals at each level. They can be entered automatically into the account register at the right time.Įxpense and income categories can be arranged in a tree structure.They can be displayed on a calendar or list on the summary page to see the exact day the transaction will take place.For example, maybe you buy groceries every 4 days. They have a more flexible scheduling feature.This makes it possible to forecast account balances. They allow you to specify which account the transaction is associated with.Transaction Reminders can take you further. But that’s about as far as a budget item can take you. They both indicate an amount, a category and a frequency. Transaction Reminders are similar to budget items that you would set up in a Moneydance budget. Money Foresight uses your configured Transaction Reminders to generate a forecast or review. It shows you where your spending needs to be adjusted to keep you on track so the review functionality performs the same function as a budget. And that’s essentially the purpose of a budget. However, this feature does an equally good job of showing where your spending needs to be adjusted. So the review functionality was intended to show where reminders needed to be adjusted. If your reminders aren’t in line with your actual spending then you can’t trust the forecast. The Reminder Review feature was added as a way to verify the accuracy of the forecast. Money Foresight started out with just the forecasting functionality. Seeing this in practice makes us wonder why more programs don't do the same.Moneydance provides two ways to do budgeting. Moneydance beats out its competition by aiming for the online banking crowd.

Moneydance trial#

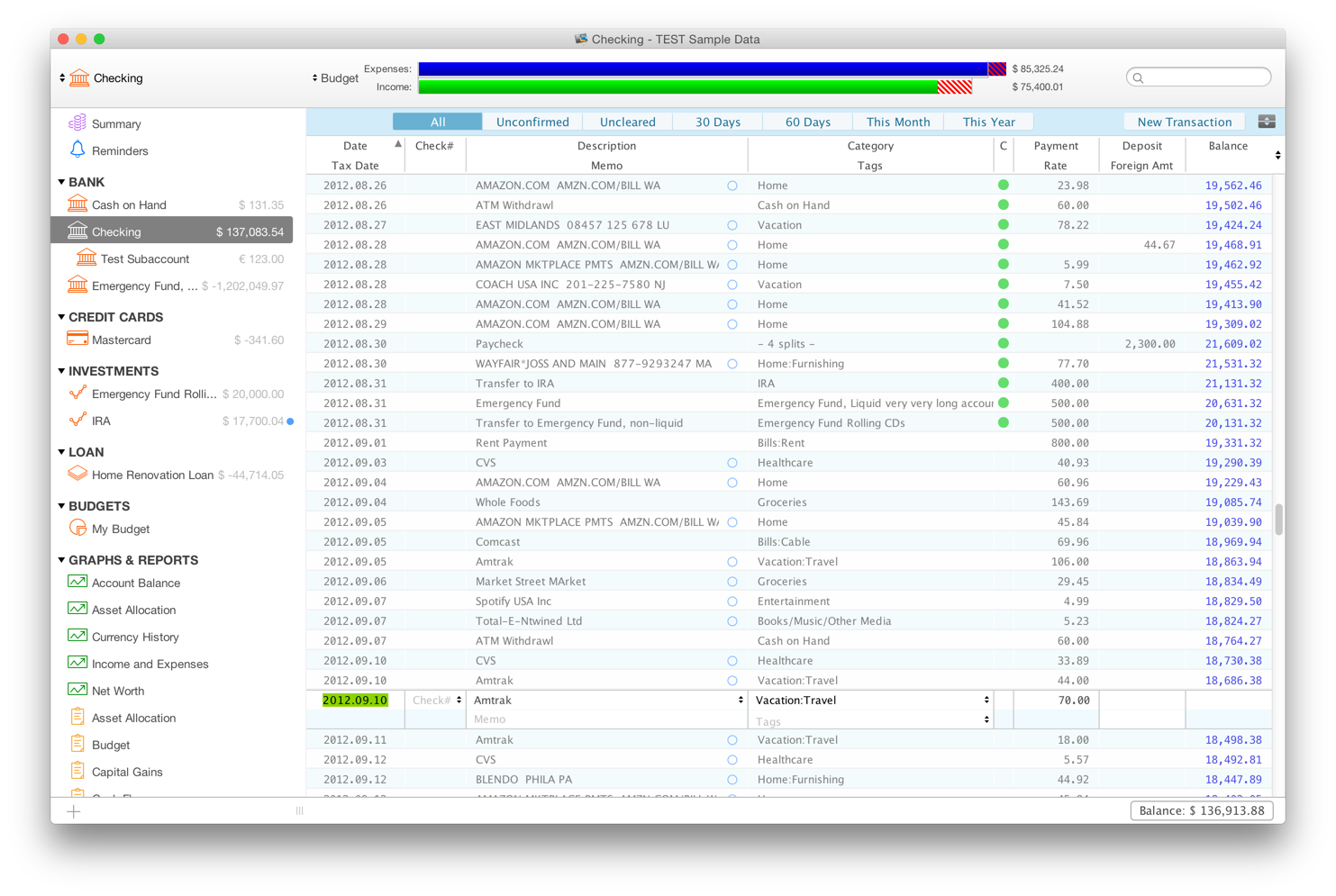

There's a 100-use trial limitations and some of the numerous features are disabled, but you can still get a good sense of this effective money manager. This is a great option for users who have their finances spread around in various accounts and have a difficult time getting an overall picture. Moneydance has the capability to hook into your various bank accounts and draw the information for you. Many simple financial programs require users to manually enter every dollar that comes in and out of their various holdings.

Where Moneydance steps ahead of most of its competition is data entry.

All the options are easy to access and fairly intuitive to understand. In the brown and green header users can cycle through options to manage their funds, such as transfers, accounts, extensions, and more. Users instantly see their balance in the heart of the rectangular screen, a calendar to the right, and reminders above that.

Moneydance download#

This download has a fairly simple look that will become familiar in a short time. Moneydance can give you a better understanding of your overall financial picture. This easy-to-use financial management program minimizes data entry by connecting directly with your online accounts.

0 kommentar(er)

0 kommentar(er)